Sichere mit Deiner Spende die Unabhängigkeit von Campax und ermögliche eine grüne, soziale und faire Schweiz.

Gemeinsam wollen wir verhindern, dass Wölfe in der Schweiz wieder massenhaft getötet werden. Lass uns die Diskussion zurück in die Öffentlichkeit holen und der Hetze gegen den Wolf entgegentreten. Damit unsere Arbeit und unsere Kampagne zum Schutz der Wölfe Wirkung zeigen, brauchen wir Unterstützung. Bestell jetzt deine kostenlose Tasche und hilf uns dabei, die Botschaft an möglichst viele Menschen weiterzugeben.

Über 740'000 Campax-Engagierte setzen sich gemeinsam ein für eine soziale und ökologische Schweiz

Campax ist die grösste Schweizer Bürger*innenbewegung. Unser Verein führt Kampagnen zu selbst gewählten Themen und unterstützt Menschen und Organisationen dabei, unser Land zu einem besseren Ort zu machen.

Mehr erfahren

Aktuelle ACT Themen

make change happen

(Change-maker)

Unser Erfolgsrezept ist das Engagement vieler Einzelner. Menschen setzen sich gemeinsam für wichtige Themen ein und sorgen mit Spenden für eine stabile finanzielle Basis. Zugleich sichert die Schwarmfinanzierung unsere Unabhängigkeit. Einzelspenden sowie monatliche und jährliche Beiträge ermöglichen die Planung und Umsetzung schlagkräftiger Kampagnen. Werde auch du Change-maker und fördere Campax!

News

- Alle

- News

- Wahlen & Abstimmungen

- Flucht & Asyl

- Gleichstellung

- Klima

- Tiere

- Menschenrechte

- Whistleblowerschutz

- ACT

- Antirassismus

- Wohnen

- 05. August 2025

- Allgemeines

- ACT

Schliesse dich der vom Zürcher Schriftsteller Thomas Meyer (u.a. «Wolkenbruch» oder «Trennt euch!») gestarteten Petition an, damit die Schweiz Palästina als Staat anerkennt!

- 08. Juli 2025

- News

- Campax

- Gleichstellung

Gegen Rape Culture: Gesellschaftspolitische Aspekte sexualisierter Gewalt Am 23. Juni hat uns Agota Lavoyer das Thema sexualisierte Gewalt näher gebracht, Fragen beantwortet und uns allen viel neuen Stoff zum Nachdenken, Diskutieren und Reflektieren mitgegeben.Agota Lavoyer ist Autorin (unter anderem von…

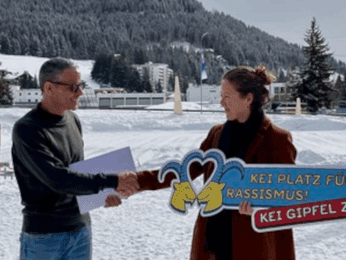

- 07. Juli 2025

- News

- Antirassismus

- Erfolgsmeldung

Das Bündner Gratisblatt "Gipfel Zytig" veröffentlicht immer wieder rassistische Grafiken und Texte. Da auch juristische Verurteilungen nicht gewirkt haben, hat sich Campax an das Davoser Gewerbe gewandt mit der Forderung, nicht mehr in der Zeitung zu inserieren – mit Erfolg. …

- 03. Juli 2025

- News

- Campax

- Gleichstellung

Gemeinsam sichtbar gegen Sexismus 03/07/2025 Jen Mein Herz raste. Mehr als 29’000 Menschen im Stadion – und wir mittendrin: Campax-Aktivist*innen mit einem Banner. In riesigen Buchstaben steht da: #stopsexism. Wir wollen gesehen werden und das ist uns gelungen! Denn wir…

- 23. Juni 2025

- Menschenrechte

- News

Wie kann man mehr als 20 Organisationen, nationale Parteien und Gewerkschaften für eine dringende Aktion bewegen? Der Erfolg der Demo für Gaza am letzten Samstag ist das Ergebnis von viel Grosszügigkeit, Engagement und Arbeit zivilgesellschaftlicher Akteur*innen. Campax hat viel Koordinations-,…

- 20. Juni 2025

- ACT

- Flucht & Asyl

- Menschenrechte

Aufruf: Kinder auf den Fluchtwegen Für viele Kinder und Jugendliche ist Europa die letzte Hoffnung auf Sicherheit vor Verfolgung, Gewalt und Krieg. Doch statt Schutz erfahren sie Ablehnung, Leid – oder verlieren sogar ihr Leben. Auch die Schweiz trägt Verantwortung:…

Unsere Social Media-Präsenz

Wir sind schon lange in den Sozialen Medien wie Instagram, Facebook, TikTok, Bluesky und LinkedIn aktiv.